The following are guidelines for preparation of 1099’s for 2022. As always, we would be happy to prepare these information returns for you, if you wish. We ask that you complete the attached information sheet and return it to us by January 13, 2023 in order for us to meet filing deadlines.

We recommend you use Form W-9 to confirm mailing addresses and taxpayer identification numbers for reportable payments. Call us if you need any help with this.

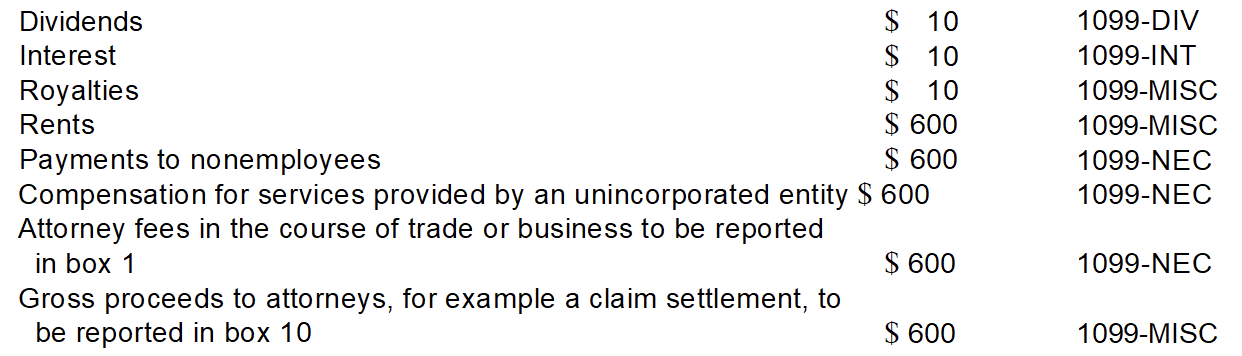

Here is a list of thresholds for various 1099’s.

Form 1099-DIV, Form 1099-INT, Form 1099-MISC and 1099-NEC need to be provided to the recipient by January 31, 2023. Please call us if you need more specific information. We recommend you file the government copy electronically with the IRS. Form 1099-NEC on paper or electronically is due January 31, 2023. All other electronically filed 1099’s are due to the IRS by March 31, 2023.

View the information sheet here.

For more 2022 tax reminders, view our client letter here.

Treasury Circular 230 Disclosure

Unless expressly stated otherwise, any federal tax advice contained in this communication is not intended or written to be used, and cannot be used or relied upon, for the purpose of avoiding penalties under the Internal Revenue Code, or for promoting, marketing, or recommending any transaction or matter addressed herein.

Home

Home Sign In

Sign In Make a Payment

Make a Payment Search

Search