Governor Mike DeWine has recently enacted Amended Substitute House Bill 33 (HB 33), bringing significant benefits to Ohio businesses and their owners. This legislation, which includes several advantageous changes for taxpayers, will have a two-step implementation process. Operating appropriations are already in effect as of July 4, 2023, while the remaining provisions will come into force on October 3, 2023, unless otherwise stated in the bill.

Below we have summarized 2 key policy provisions to be aware of. Please call us for more details regarding how this impacts you and your business.

Ohio CAT (Commercial Activity Tax) Update

• For 2024, Ohio CAT exclusion will increase from $150,000 to $3 million and rise to $6 million in 2025.

• This means anyone under those thresholds will not have to pay the CAT. However, it’s important to note that all businesses, regardless of the exclusion, will still be required to file quarterly tax returns under the current law. While there is a possibility that this filing requirement may change, the outcome remains uncertain at this time.

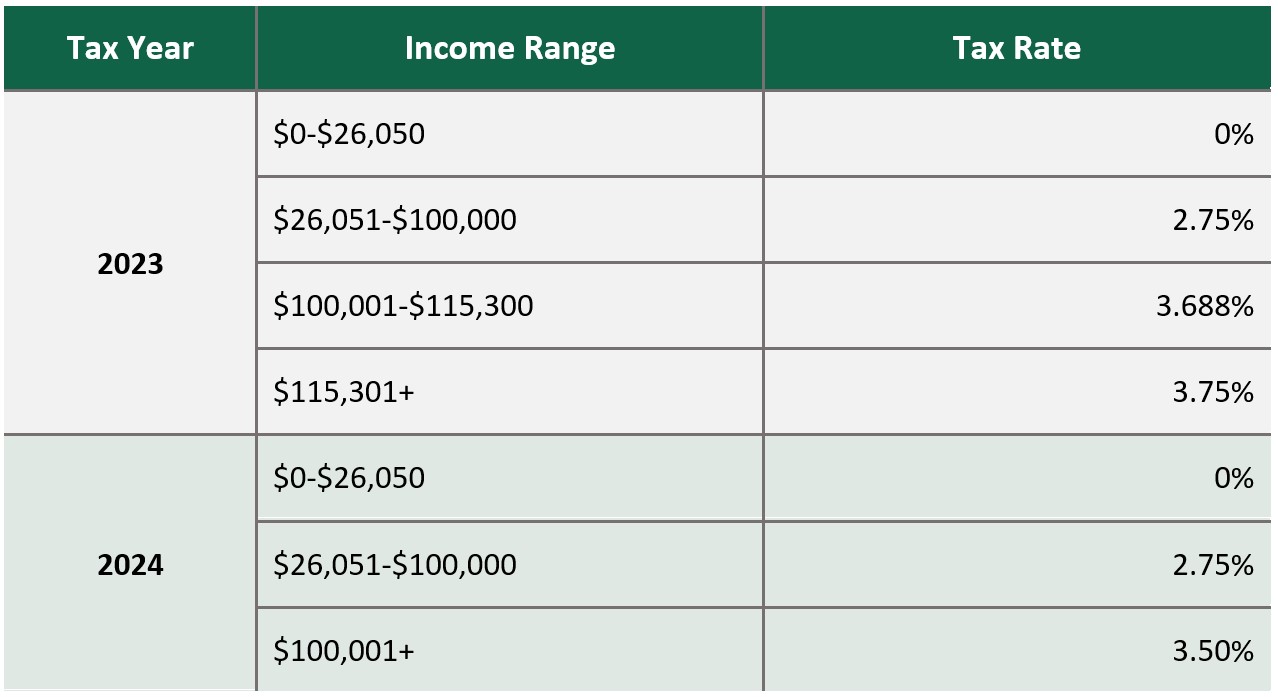

Income Tax Bracket

• Starting in 2023, the income tax brackets in Ohio will undergo simplification, going from 4 brackets to just 3. And the following year, by 2024, there will be only 2 brackets.

Treasury Circular 230 Disclosure

Unless expressly stated otherwise, any federal tax advice contained in this communication is not intended or written to be used, and cannot be used or relied upon, for the purpose of avoiding penalties under the Internal Revenue Code, or for promoting, marketing, or recommending any transaction or matter addressed herein.

Home

Home Sign In

Sign In Make a Payment

Make a Payment Search

Search