Sandusky, Ohio – July 8, 2024 – Payne Nickles & Company CPAs and Business Advisors is proud to announce the promotion of four outstanding team members in recognition of their dedication, hard work, and contributions to the firm. Tanner Stiert, CPA, has been promoted to Manager. Tanner graduated from Miami University with a B.S. in …

Read More...Sandusky, Ohio – July 8, 2024 – Payne Nickles & Company CPAs and Business Advisors is proud to announce the promotion of Brennan Otto, CPA, to Partner in Training in recognition of his dedication, hard work, and contributions to the firm. Brennan Otto’s journey with Payne Nickles & Company began as an intern during the …

Read More...As a business owner, the Profit & Loss (P&L) report is one of your most vital tools. This financial statement gives a window into your business, revealing how your money is generated and spent. The main goal of the P&L report is to understand how your business has earned a net profit or incurred a …

Read More...A common question, and one where many taxpayers often make mistakes, is whether it is better to receive a home as a gift or as an inheritance. Generally, from a tax perspective, it is more advantageous to inherit a home rather than receive it as a gift before the owner’s death. This article will delve …

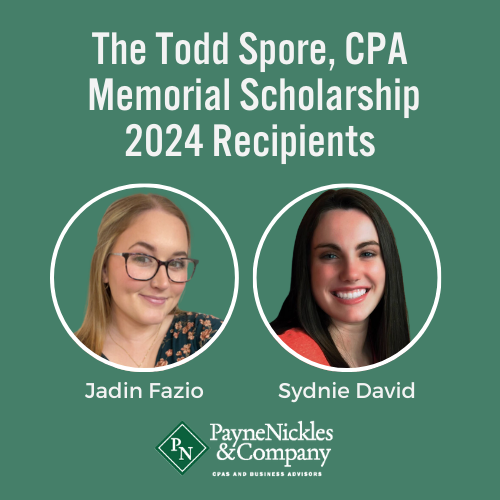

Read More...Payne Nickles & Company, CPAs proudly announce the Todd Spore, CPA Memorial Scholarship recipients for the 2024-25 academic years! The annual scholarships are funded through an account established by Payne Nickles & Company, CPAs within the Huron County Community Foundation, and are available to any first, second, third, fourth, or fifth-year accounting major in Erie, …

Read More...Navigating the complexities of business ownership requires a keen understanding of financial planning. A comprehensive financial plan is more than just a set of documents; it’s a roadmap that guides your business through the ever-changing landscape of commerce, helping to steer day-to-day decisions and long-term strategies. Essential Components of Financial Planning Efficient cash management is …

Read More...In the construction industry, effective record retention is not just a matter of administrative housekeeping; it is a critical component that can influence legal standing, financial health, and company reputation. Establishing a robust record retention policy is essential, ensuring all necessary documents are maintained to support business operations, comply with regulations, and prepare for potential …

Read More...In the construction industry, where innovation and efficiency are key to success, the Research and Development (R&D) tax credit is a powerful yet underutilized tool for small to medium-sized construction companies. Often perceived as the domain of tech giants and manufacturing behemoths, the R&D tax credit holds significant potential for the construction industry, offering financial …

Read More...Written by: Abbey Bemis, MBA The most common reason businesses report failing is their cash flow management (SCORE). At Payne Nickles we know cash flow is not just a driver of business failure, but instead a huge part of company success when properly managed, driving a company’s operational efficiency and strategic growth. Effective accounts receivable …

Read More...Written by Jeffrey J. Rosengarten, CPA, CFE Navigating the realm of capital gains and optimizing tax outcomes require strategic thinking and informed decision-making. Understanding and employing effective capital gains tax strategies is crucial for businesses contemplating asset sales or long-term investments. However, it’s important to note that every business situation is unique, and leveraging the …

Read More... Home

Home Sign In

Sign In Make a Payment

Make a Payment Search

Search