At Payne Nickles & Company, we believe effective accounting goes far beyond compliance; it should be a strategic advantage for your business. Our approach focuses on more than just preparing tax returns and reviewing statements. We can help our clients make proactive decisions all year long.

This four-part series highlights practical—but often overlooked—strategies that can significantly improve your tax outcomes and financial clarity. These articles are packed with guidance and real examples from the work we do every day.

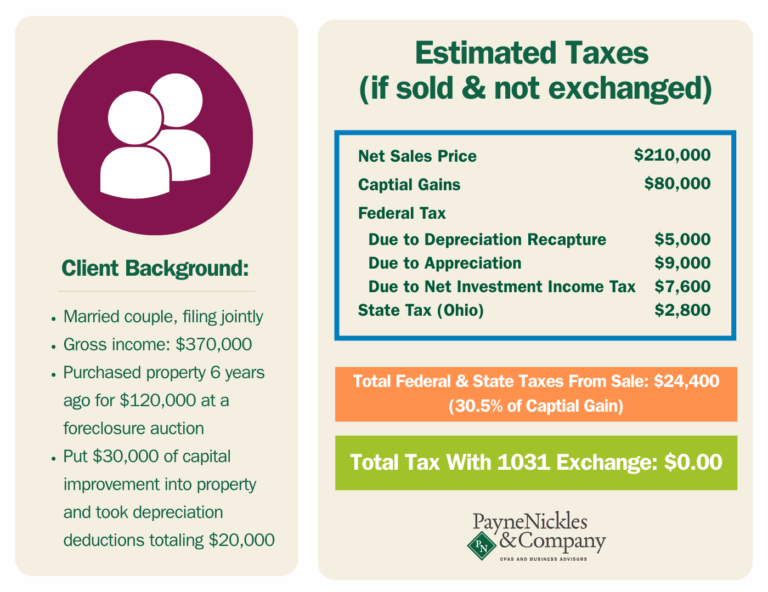

This month, we’re looking at a strategy that can help real estate investors preserve capital and build long-term wealth: 1031 Exchanges.

What Is a 1031 Exchange?

A 1031 Exchange allows you to sell an investment property and reinvest the proceeds into another like-kind property, while deferring capital gains taxes. Instead of giving up a portion of your profit to taxes, you keep your money working for you.

Here’s how it works:

- U.S. Property Requirement – Both the sold and replacement properties must be located in the United States.

- Strict Timelines – You have 45 days to identify your replacement property and 180 days to complete the transaction.

- Qualified Intermediary – The IRS requires a third-party intermediary to hold sale proceeds and facilitate the exchange.

Why 1031 Exchanges Matter

For investors, a 1031 Exchange isn’t just about deferring taxes, it’s about creating opportunities. By rolling your investment forward, you can:

- Reallocate funds into properties that better fit your goals.

- Diversify your portfolio while maintaining real estate holdings.

- Keep more capital compounding toward long-term growth.

Who Should Consider a 1031 Exchange?

A 1031 Exchange can be a smart strategy for:

- Investors who want to keep real estate as a core part of their portfolio.

- Those looking to diversify property types, income streams, or markets.

- Accredited Investors who meet specific income, net worth, or licensure requirements.

Who Might Not Benefit?

1031 Exchanges don’t apply to every property or investor. They’re not ideal for:

- Sales of primary residences or vacation homes (generally not eligible).

- Investors who want immediate access to cash from a sale.

A 1031 Exchange in Action

Let’s Talk

Considering selling an investment property? Before moving forward, it’s essential to talk with a tax professional. Our team can guide you through the process, connect you with qualified intermediaries, and ensure your transaction is structured to maximize benefits.

Treasury Circular 230 Disclosure

Unless expressly stated otherwise, any federal tax advice contained in this communication is not intended or written to be used, and cannot be used or relied upon, for the purpose of avoiding penalties under the Internal Revenue Code, or for promoting, marketing, or recommending any transaction or matter addressed herein.

Home

Home Sign In

Sign In Make a Payment

Make a Payment Search

Search