At Payne Nickles & Company, we believe effective accounting goes far beyond compliance; it should be a strategic advantage for your business. Our approach focuses on more than just preparing tax returns and reviewing statements. We help our clients make proactive decisions all year long.

This four-part series highlights practical—but often overlooked—strategies that can significantly improve your tax outcomes and financial clarity. These articles are packed with guidance and real examples from the work we do every day.

This month, we’re looking at a strategy that’s gaining momentum among a wide range of investors: Direct Indexing.

What Is Direct Indexing?

Direct indexing is an investment strategy where, instead of buying an index fund or ETF, you directly own the individual stocks that make up a chosen benchmark index. These holdings are kept in a separately managed account, giving you:

- Market exposure similar to the index.

- Tax advantages through active tax-loss harvesting.

- Personalization by excluding or overweighting certain companies or sectors.

Because you own the securities directly, you can better manage capital gains, customize around your preferences, and use losses more strategically.

Why Direct Indexing Matters

Traditional mutual funds and ETFs pool investors together, which often leads to taxable distributions that you can’t control. With direct indexing, you decide when gains are realized and can use losses to your advantage.

Here’s what that looks like:

- Better tax efficiency – Losses harvested throughout the year become valuable tax “assets” that can offset gains, reduce your overall liability, or even offset up to $3,000 of ordinary income annually.

- More control – You decide when to sell and how to structure your holdings, rather than being tied to the actions of a fund manager.

- Greater customization – Exclude companies or sectors that don’t align with your goals and values, or increase exposure to areas where you see long-term opportunity.

- Smarter risk management – Direct indexing helps diversify concentrated stock positions, such as company stock from compensation packages, in a tax-conscious way.

Who Should Consider Direct Indexing?

Direct indexing may be the right fit if you:

- Have taxable brokerage assets and want more flexibility than traditional mutual funds or ETFs.

- Expect a large financial windfall from selling a business, property, or a sizable stock position.

- Want to align your investments with personal or ethical values.

Who Might Not Benefit?

Direct indexing isn’t ideal for every investor. It may not be the right fit if you:

- Hold only retirement accounts (like IRAs or 401(k)s), where gains are already tax-deferred.

- Prefer simple, hands-off investing without customization.

The Tax Efficiency Advantage of Direct Indexing

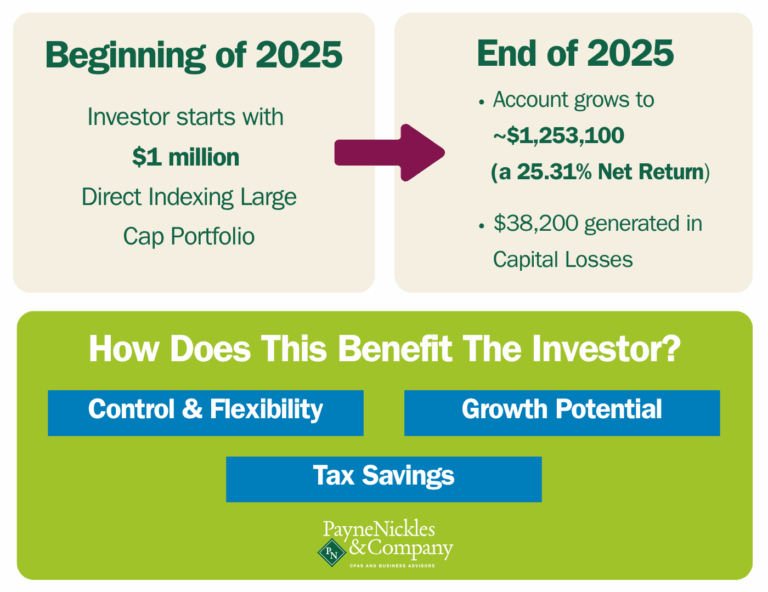

Direct indexing isn’t just an investment approach; it can also be a smart way to manage taxes. By using tax-loss harvesting, you can sell certain investments that have lost value to offset gains or income from other sources. This helps lower the amount of tax you owe and can improve your after-tax results over time. Because direct indexing lets you own and manage individual stocks instead of investing in a single fund, you have more control over when to recognize gains or losses.

With guidance from a CPA, this flexibility can become an important part of a well-rounded tax plan that helps you keep more of what you earn and build long-term wealth.

A Real-World Scenario: How Does This Benefit the Investor?

Ready to Explore the Tax Benefits of Direct Indexing?

At Payne Nickles & Company, we focus on helping clients understand the tax implications and potential advantages of strategies like direct indexing. While we don’t provide investment management services, our team can advise on the tax planning and reporting considerations that support your overall financial picture.

Our sister company, PN Financial Services, LLC, can help you take the next step toward your broader financial goals. To learn more about which financial strategies may work for you, please visit our affiliate PN Financial Services for detailed information on financial services.

Treasury Circular 230 Disclosure

Unless expressly stated otherwise, any federal tax advice contained in this communication is not intended or written to be used, and cannot be used or relied upon, for the purpose of avoiding penalties under the Internal Revenue Code, or for promoting, marketing, or recommending any transaction or matter addressed herein.

Home

Home Sign In

Sign In Make a Payment

Make a Payment Search

Search